Goods and Services Tax (GST) is an indirect tax applied to the supply of goods and services, aimed at creating a unified taxation system across India. Enacted by the Parliament on March 29, 2017, GST came into effect on July 1, 2017, replacing multiple indirect taxes and promoting tax uniformity.

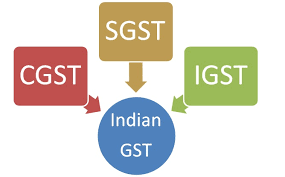

Under the GST framework, taxes are levied at every point of sale. For intra-state sales, both Central GST (CGST) and State GST (SGST) are applied. In the case of inter-state sales, the Integrated GST (IGST) is charged, streamlining tax collection and distribution between the central and state governments.

Advantages of GST

GST has significantly reduced the cascading effect on the sale of goods and services. By eliminating the “tax on tax” structure, it has effectively lowered the cost of goods, benefiting both businesses and consumers.

Another notable feature of GST is its technological foundation. All processes, including registration, return filing, refund applications, and responding to notices, are conducted online through the GST Portal. This digital approach not only simplifies compliance but also accelerates and streamlines the overall process.

What are the components of GST?

Types of Taxes Under GST:

CGST (Central Goods and Services Tax):

Collected by the Central Government on intra-state sales.

Example: A transaction occurring within Maharashtra.SGST (State Goods and Services Tax):

Collected by the State Government on intra-state sales.

Example: A transaction occurring within Maharashtra.IGST (Integrated Goods and Services Tax):

Collected by the Central Government on inter-state sales.

Example: A transaction from Maharashtra to Tamil Nadu.

Elimination of Cascading Effect:

Under the pre-GST regime, every purchaser, including the final consumer, paid tax on tax, known as the cascading effect. GST has resolved this issue by ensuring that tax is levied only on the value added at each stage of ownership transfer, significantly reducing the overall tax burden.